The Big Cs of Private Equity

After the economic downturn, the new framework for successful private equity careers is clearer than ever before.

Instead of working fruitlessly to secure the same levels of pre-crisis profits the PE sector as a whole has shifted focus, becoming determined to adapt and thrive in the new normal. Inevitably, the new normal isn’t as a strong as the old one, as noted by Bain Capital. Being able to manage costs and use tools like leverage with a little more finesse are now an industry must.

Success for private equity firms means analyzing every facet of how their deals are sourced, and their portfolios are managed. Often this also entails assessing to what extent their offices are made efficient and predictable, and their models repeatable. No gambling and no Martingales. Well, maybe some.

What’s certain is that PE firms are no longer gambling on their employees as they discover and optimize their new cost margins. What does this mean for you?

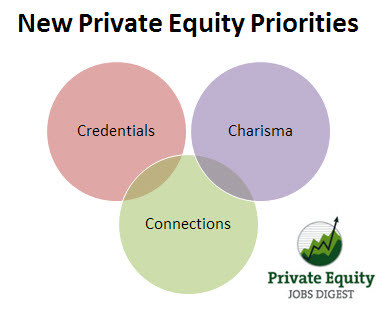

It means you need three C’s more than ever to succeed: Credentials, Charisma, and Connections.

Credentials

The market today is full of premium-priced assets, and a private equity firm’s general partners need to dig deep for the best – without overpaying. This applies as much to labor as it does to capital, and partners know that. That means have your credentials ready.

Whether it’s a Chartered Financial Analyst certification, impressive internship experience, or a brilliant set of academic transcripts. These are the bare minimums for any private equity firm worth its salt. Not surprisingly, a love of competition also helps.

Wall Street loves – and often favors – athletes, all else being equal. In fact, Wall Street loves sports so much they sometimes let it get the best of them in deciding good investments.

Charisma

Just as top firms talk big about their particular industry and sector expertise to secure good deals you need to parlay your way into their sweet spot – find the industries and sectors your firms of interest focus on and make sure you pair up. If they don’t, you’re probably out of luck. Remember, these are firms that do their due-diligence to sort trash from treasure on a daily basis. Of course, it’s just as important to remember: even if you’re a perfect match it means nothing if you can’t convince them.

Connections

Next – and this goes for any job – figure out who you know in the industry. Who are they, what do they do, and how can they help you? Kant might have said to treat people not as means but as ends in themselves but no one in PE studied philosophy.

For many a job in finance employers want to be able to put a personality with the paper you send to them and there’s no better way to help them do that than if someone on the inside can talk about you personally. Go to networking events any chance you get and make connections.

Finally, as private equity firms are working to make their models repeatable you should be doing the same when you’re in the job hunt.

Make sure you’ve perfected your three C’s and then determine where you want to end up before you start. Keep that goal in mind and drive home your niche to every prospective employer.

Right now firms are taking on operating executives, former management consultants, and anyone who can bring a fresh perspective to their team.