Carried Interest or simply “carry” is incentive compensation provided to private equity fund managers to align their interests with the fund’s capital-providing investors.

Basically, carry is a percentage of a fund’s profits that fund managers get to keep on top of their management fees, and is a significant component of private equity compensation. Carry typically averages about 20% of the fund’s profits and ranges from as high as 50% in exceptional cases to as low as in the single digits. With the proliferation of private equity funds, there is increasing downward pressure on carry as fund managers compete with each other to attract investor capital.

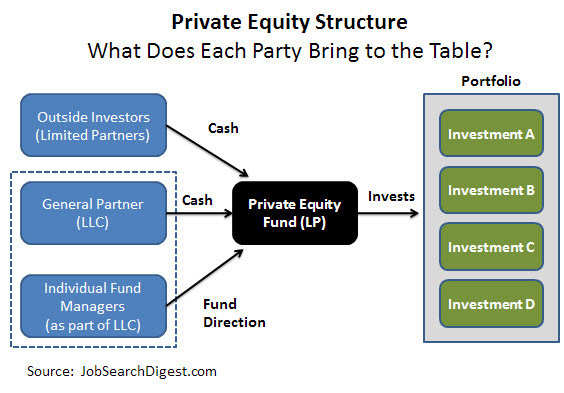

Private Equity Structure

Figure 1: Private Equity Structure

The investment team consists of Individual Fund Managers who come together to form a General Partner entity (the private equity firm) under which they raise capital for a Fund, and identify and manage investments in Portfolio Companies. The General Partner typically invests anywhere from 1% to 3% of the total fund. The rest of the money comes from outside investors – wealthy individuals, trusts, pension funds, asset management companies, etc. – each of which is a Limited Partner in the fund, with its share proportional to its capital contribution. Some private equity firms also have institutional sponsors or are captive units or spinoffs of other companies.

Carried Interest Factors

Carried interest is the share of a fund’s net profits allocated to the General Partner. It refers to the General Partner being carried by investors because it receives a share in profits disproportionate to its capital commitment to the fund.

Fund managers receive carry and a management fee, which industry executives feel is justified because each investment requires a lot of work to generate a profit. Fund managers do a lot of due-diligence before making an investment because they invest massive chunks of capital, typically to acquire majority ownership. Thereafter, fund managers are heavily involved in strategy, business development, financial management and restructuring, and operational details. They work to turn a company back to profitability, to restructure it to generate higher returns, or to unlock hidden value – all the way through a liquidity event (an acquisition, an IPO, or a recapitalization).

Carry is typically vested over anywhere from 1 year (in very rare cases) to 6 years (on the high side), with three to four years being the average. Fortunately for investors, a higher title within the firm does not result in a shorter vesting period. Investors prefer multi-year vesting periods to keep fund managers focused on long term profitability.

Need a Private Equity Resume?

Private Equity Resume Sample

If you are looking at making a career change and need a private equity resume, we suggest hiring from Professional Resume Writers. They provide a vetted list of top US-based resume writers with finance experience.

Equity-Based Carry

Equity-based carry is the traditional concept of carry from the time private equity firms came into being. Interest in a fund is allocated as shares based on each Limited Partner’s capital contribution, with a certain percentage of these shares (typically 20%) allocated to the General Partner as carry. Carry shares usually have a multi-year vesting period that tracks investments made. Equity carry is typically split between senior executives at the private equity firm. Keep in mind there are many flavors of carried interest so doing an apples to apples comparison of two different carry packages is difficult.

Hurdle Rates

Typically, the General Partner only receives carry when the fund generates profits above a certain hurdle rate. Think of the hurdle rate as a specific internal rate of return (IRR) – an annualized, compounded return rate that Limited Partners must get before the General Partner gets carried interest profits.

Simplistically, a Limited Partner could invest in, say, an equity index that generates a 6% annual return. By investing in a private equity fund, Limited Partners take on higher-than-market risk and want a minimum rate of return (hurdle rate) before sharing profits with the General Partner.

Assume a fund with a 10% hurdle rate and a 20% carry. When the fund makes a profit, it is first allocated so each Limited Partner receives its cumulative IRR of 10% on contributed and un-returned capital. Next, 80% of all remaining profit is allocated to partners (proportional to their respective capital commitments) and 20% is allocated to the General Partner. The General Partner typically has a 100% “catch-up” allocation on carried interest.

Floors

Some funds are structured with a “floor” where carried interest is only allocated on investments where net profits exceed the hurdle rate. There is no General Partner “catch-up” provision, and this approach, not surprisingly, is strongly resisted by General Partners.

Who Keeps Carry?

In reality, very few private equity teams get full dibs on their carry. Retired partners often get a share of carry for a certain period after they retire as part of a buyout of their equity in the firm. Private equity firms that are either spun out, have minority shareholders, or are owned by a parent company, often pay a significant chunk (10% to 50%) of carry to their old or existing owners.

Escrow and Claw-Back

Many investors demand escrow and “claw-back” arrangements so early over-payments can be returned if the fund underperforms as a whole. Practically speaking, though, claw-backs are difficult to enforce, especially if carry recipients have either left the firm or suffered major financial setbacks such as investing their carry in shares that subsequently collapsed or using carry to pay off a divorce settlement.

Carry Structures from Around the World

On average, Limited Partners are more generous in the U.S., where returns are often also more outsized than in other countries. In the U.S., it is common to see carry on a deal-by-deal basis with escrow and claw-back provisions.

Europe typically follows a whole-of-fund approach where managing partners get their share of the profits only after investors have been paid capital and returns on drawn-down capital. Some European investors disallow carry for the term of the fund, which is typically 5 years.

Private equity in Australia is dominated by a handful of limited partners who tend to push for conservative carry terms, similar to the European model. In Australia, typically, only funds with a well-established history of consistent and profitable performance are in a position to negotiate favorable carry terms.

Accounting for Carry

Private equity firms use different accounting approaches for carry. Some account for carry on an accruals basis – as investment returns are realized and portfolio valuations are periodically adjusted, carried interest accruals are adjusted. Some use the cash basis to record carry as it is paid and received. Still others use option valuation techniques to determine carry at the beginning of a new investment.

Additional Carried Interest Considerations

Calculating Net Profits and Carry Distribution

Sources:

PrivateEquityCompensation.com

Wilson Sonsini Goodrich & Rosati