Private Equity Hiring Trends – Q3 2015

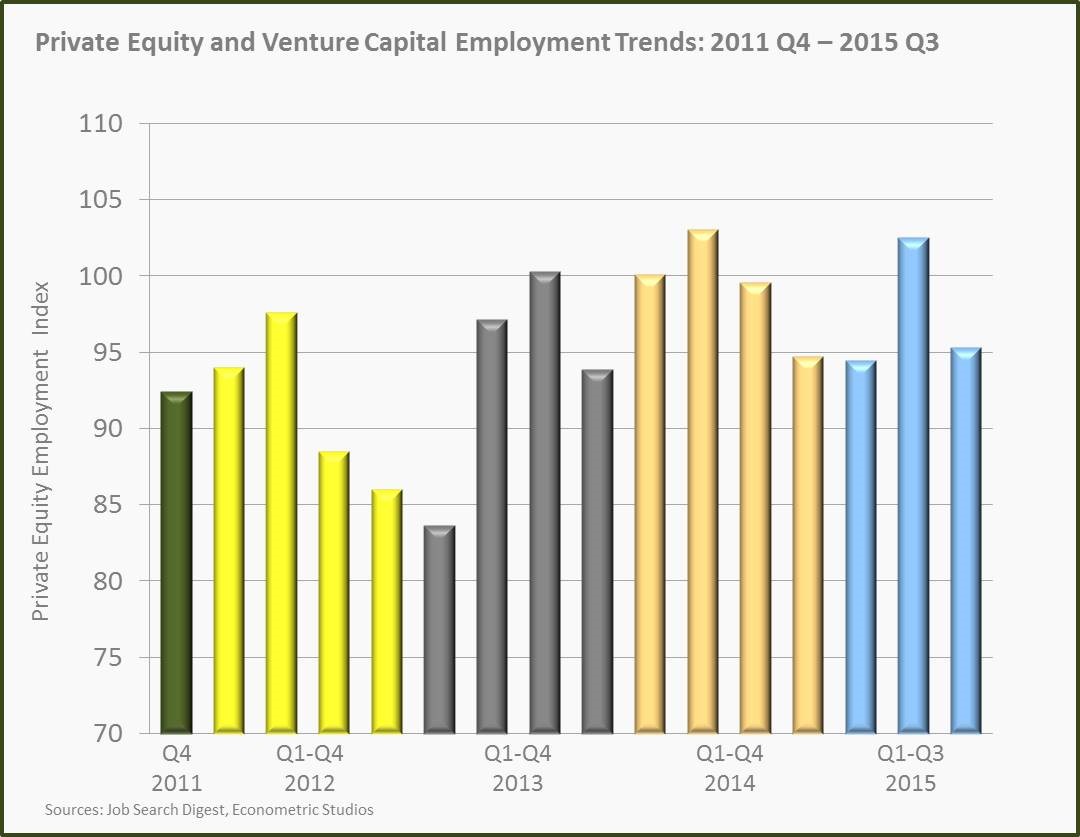

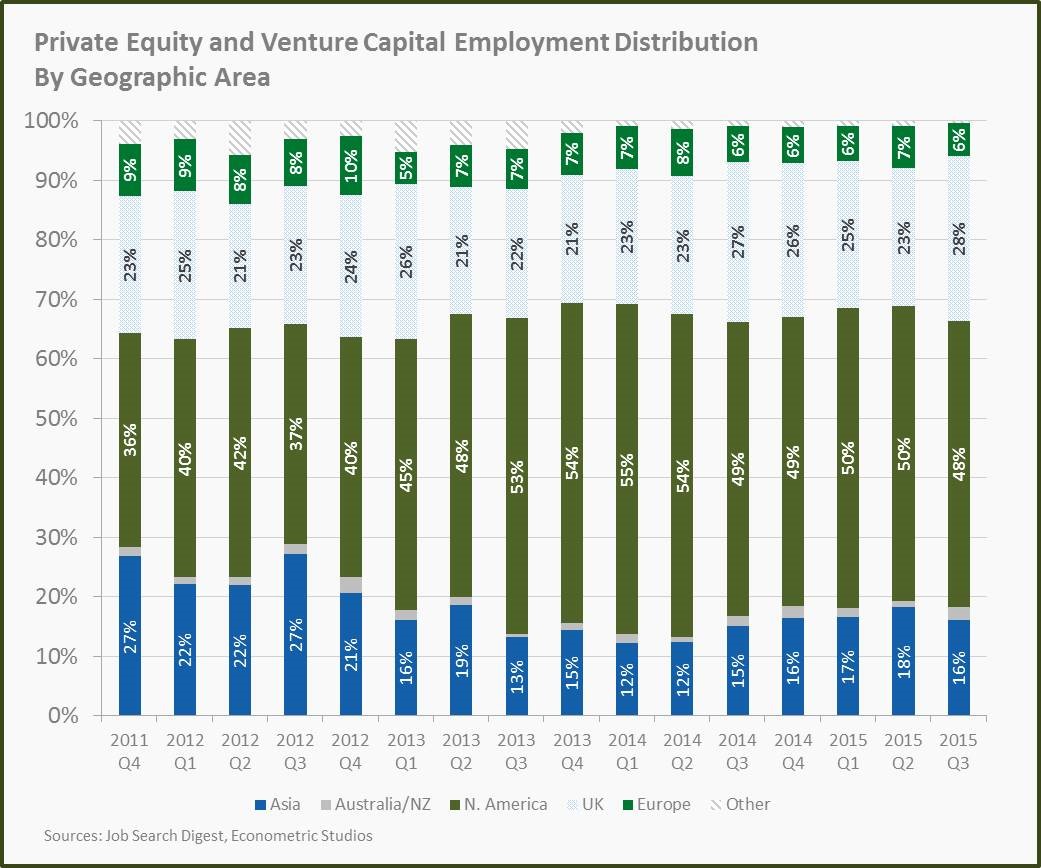

Private Equity and Venture Capital employment experienced an upsurge in Q2 2015, reaching almost the same level as in Q2 2014. However, the number of new job openings dropped in Q3 2015 almost as fast as they went up in Q2.

Global fundraising slowed down significantly during Q3. One hundred seventy funds closed, which is down 46% from the previous quarter and also significantly less than in Q3 2014.

“The global private equity fundraising market has continued to stall in the third quarter of 2015. The number of funds closed is the lowest of any quarter Prequin has on record, and aggregate fundraising totals declined for the third consecutive quarter,” says Christopher Elvin from Prequin.

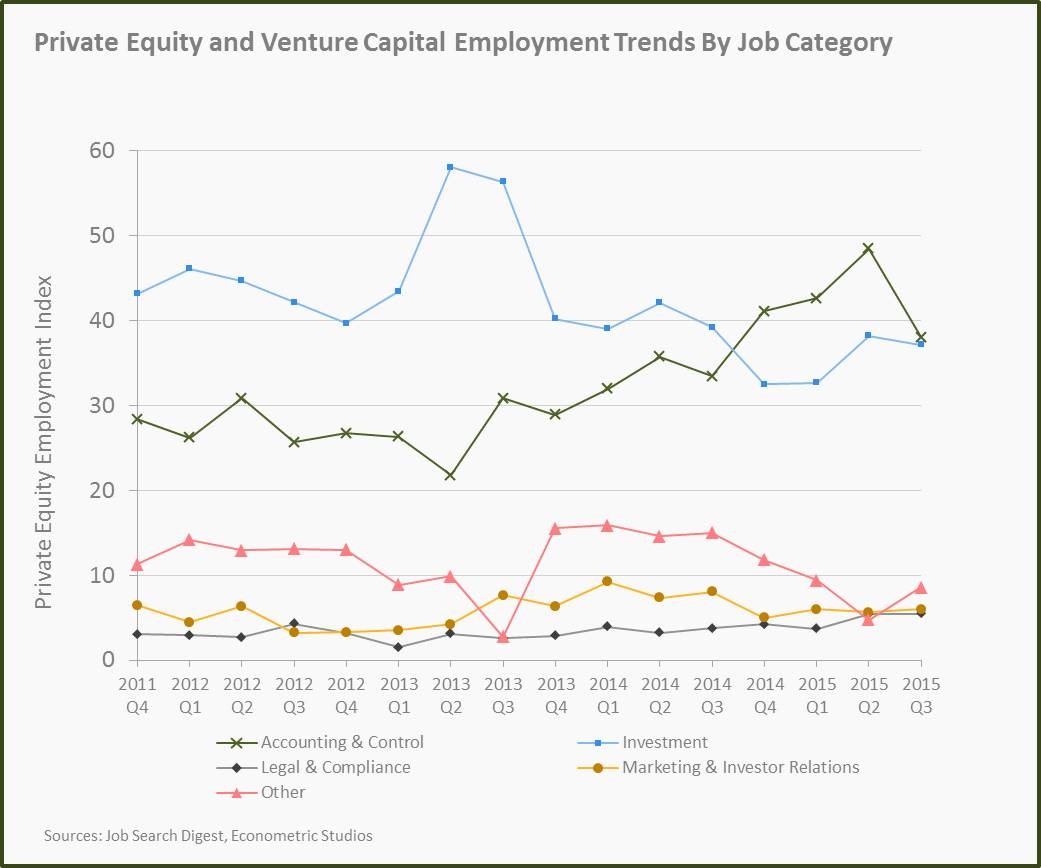

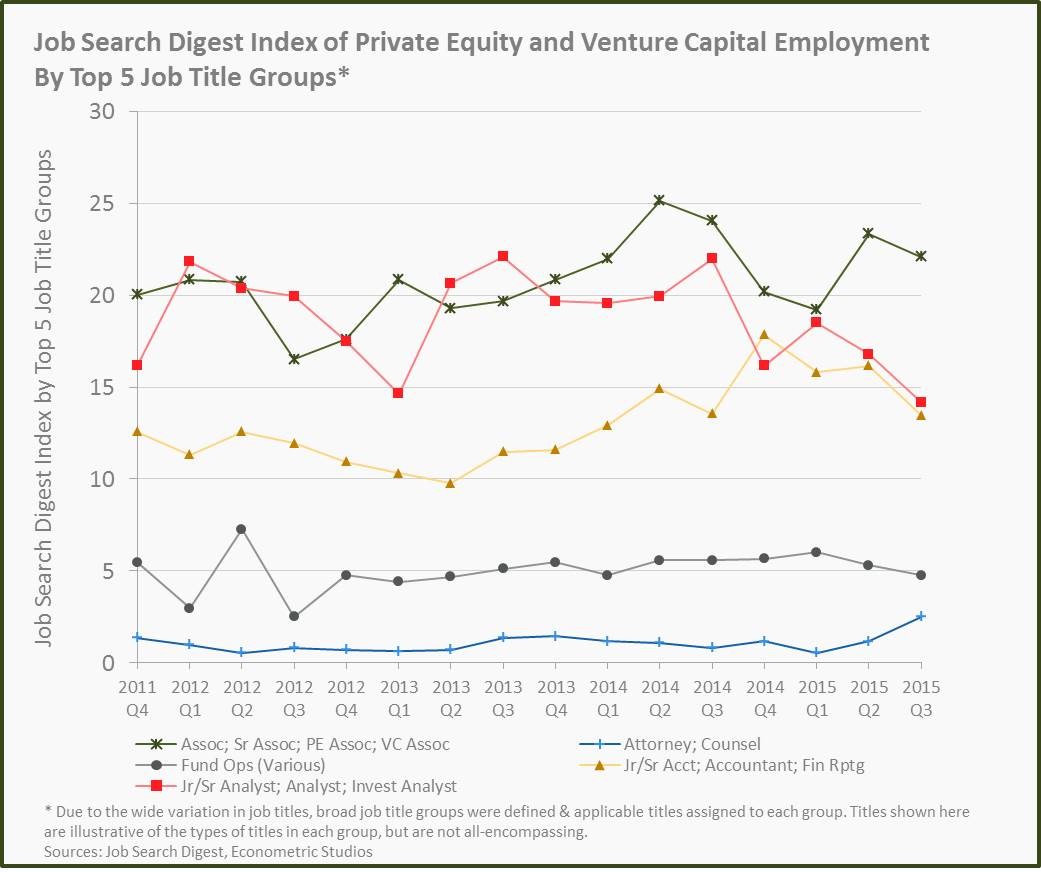

While job openings in most job categories remained stable, there was a significant drop in demand for accounting and control jobs. This job category has gone up almost consistently since Q2 2013. Third quarter 2015 may mark the peak of this trend as private equity and venture capital firms have filled their open vacancies.

Although the demand for senior positions has remained the same, and in case of attorneys it has even increased, new job openings for junior positions have dropped significantly this quarter.

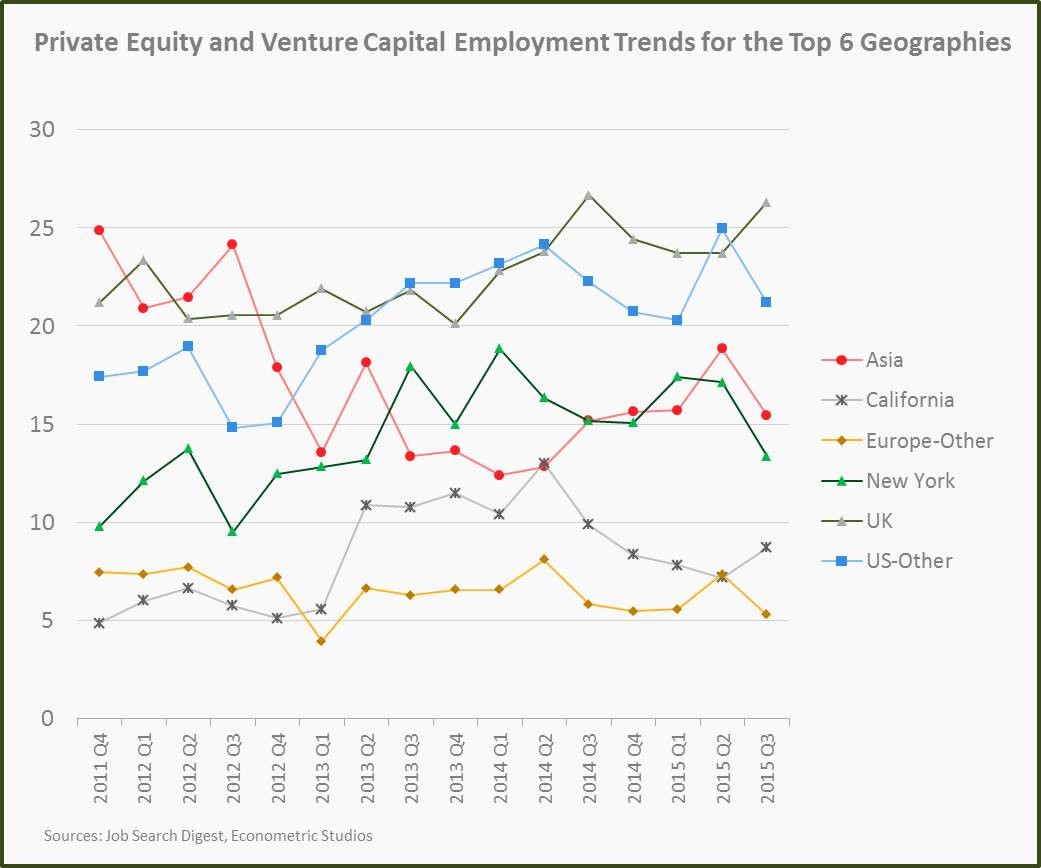

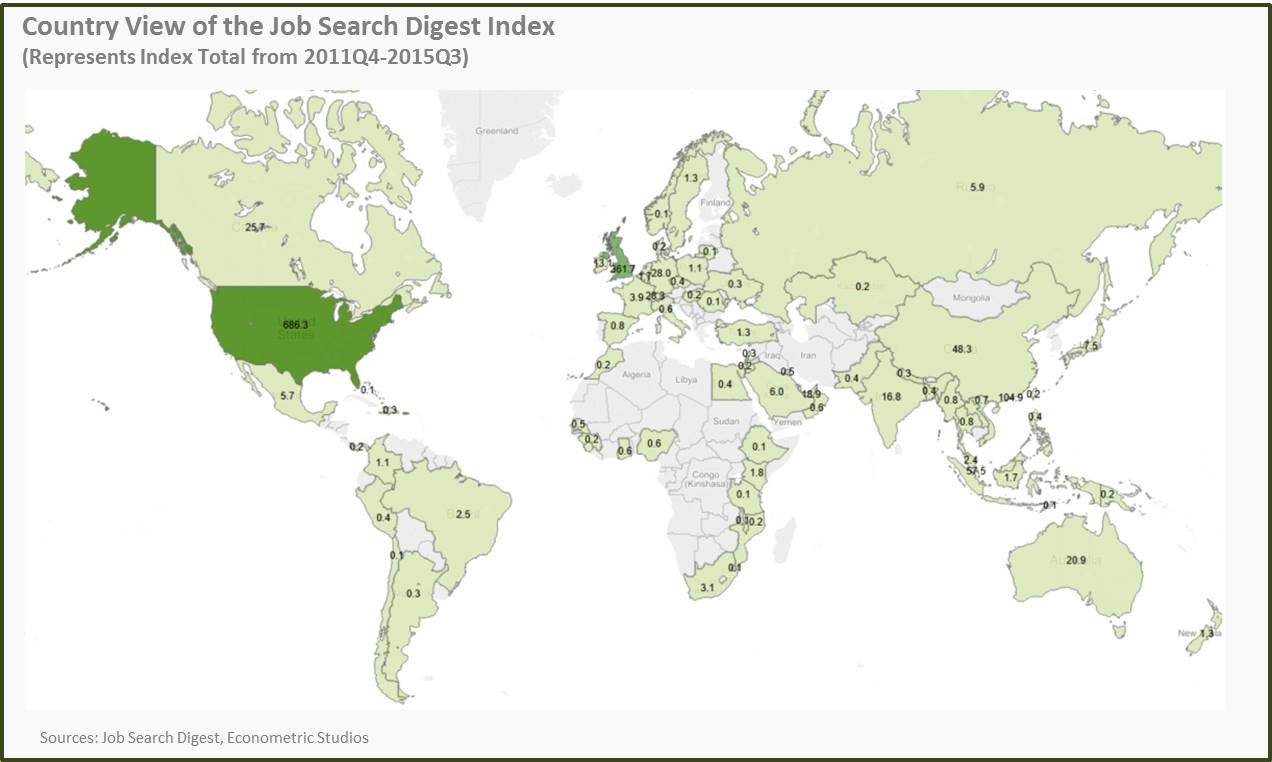

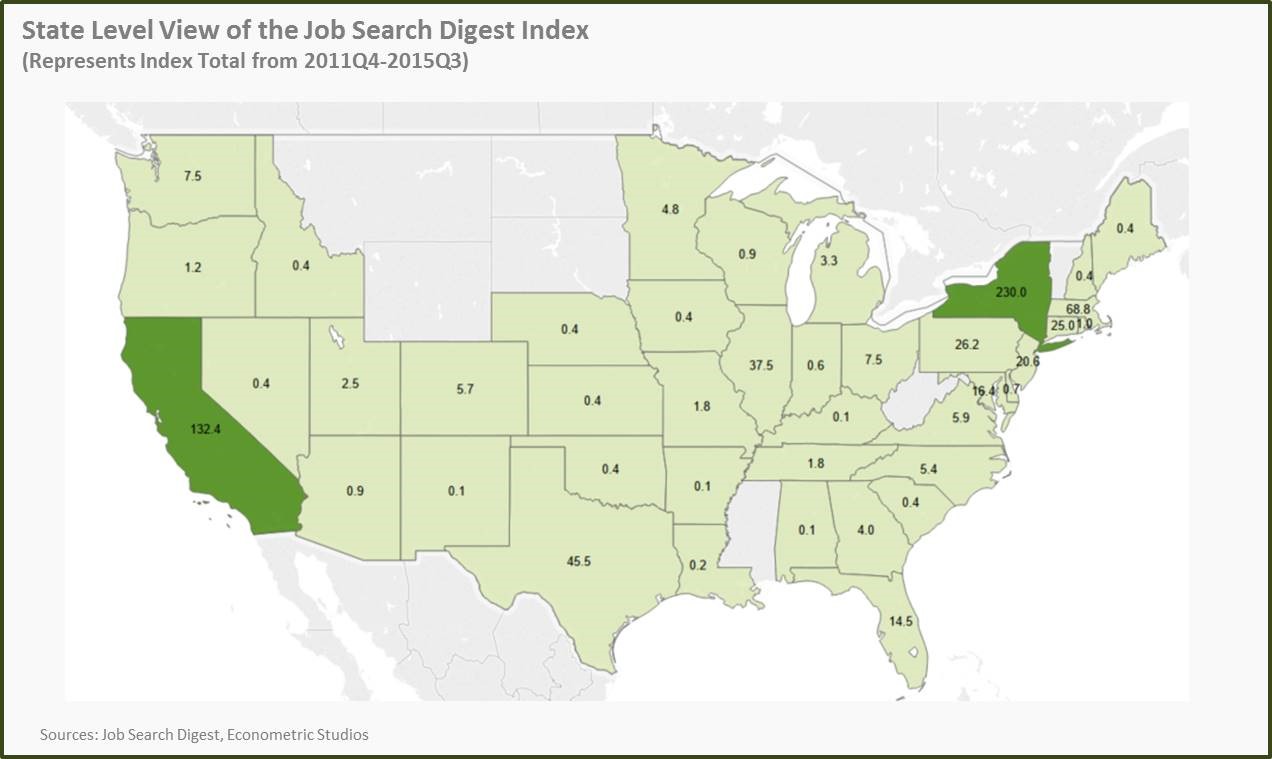

All geographical markets have seen fewer job openings in Q3 2015, except in the UK and California, where job openings have increased. That may be due to job openings rising in almost all other areas in Q2, while they have actually decreased or stagnated in California and UK over the last three quarters.

That combined with the fact that recently there has been a lot of M&A activity in the technology startup sector – California and London are major tech start-up hubs – creates a need for more recruitment in these regions.

Looking at aggregated geographical markets, private equity and venture capital employment has dropped almost everywhere, but it has increased by 5% in UK. That reverses the trend of decreasing job openings in UK that has been going on since Q3 2014. Considering the overall view that London is becoming the financial capital of the world, this upsurge of new job openings in London could continue in the future.

The US continues to be the world’s biggest private equity and venture capital market. According to Business Insider, venture capital-backed companies account for 43% of all companies floated in the US since 1979. Moreover, 38% of total jobs in the US are provided by venture capital-backed companies.

Although California and New York are by far the biggest markets in the US, private equity and venture capital employment has been growing in other states like Texas and Pennsylvania as well, albeit slow.

According to Christopher Elvin from Prequin, there is “a lack of growth in the mature North American and European markets, as both the number of funds closed and aggregate capital figures continue to fall there.”

If you are interested in learning more about what jobs are available, visit us at https://www.jobsearchdigest.com/private-equity-jobs.